Many taxpayers are watching for IRS $2,000 direct deposits arriving January 2026. This guide explains who is eligible, when payments are scheduled, and the rules that affect delivery and eligibility. Read on for practical steps to check status, update information, and resolve common problems.

IRS $2,000 Direct Deposits: What This Payment Is

The IRS $2,000 direct deposits refer to a one-time payment distributed by the federal government in January 2026. The payment is intended as direct financial support for eligible taxpayers and families under the program rules in effect for tax year 2025.

This article focuses on eligibility, key dates, deposit methods, and actions to take if you do not receive the payment.

Who Is Eligible for IRS $2,000 Direct Deposits?

Eligibility is based on income, filing status, and other criteria set by the IRS for the 2025 tax year. Most recipients will be individuals and families who meet the adjusted gross income (AGI) limits and filing requirements.

Common eligibility criteria include:

- U.S. citizens or resident aliens with a valid Social Security number.

- AGI below the program’s income threshold (check IRS announcements for exact limits).

- Filing a 2025 federal tax return or qualifying through non-filer registration methods used by the IRS.

Who is not eligible?

People who do not meet the income limits, are claimed as dependents on another return, or lack a valid SSN typically do not qualify. Nonresident aliens and some categories of visa holders are usually excluded unless otherwise specified.

Payment Dates and Delivery Methods

The IRS will begin issuing payments in January 2026. Exact dates may be staggered over several weeks depending on processing capacity and whether the IRS sends payments by direct deposit, paper check, or debit card.

- Direct deposits are generally faster and start early in the payment window.

- Paper checks and debit cards arrive later and may take several weeks to reach recipients.

- The IRS issues payment notices by mail after a payment is sent. Keep this notice for your records.

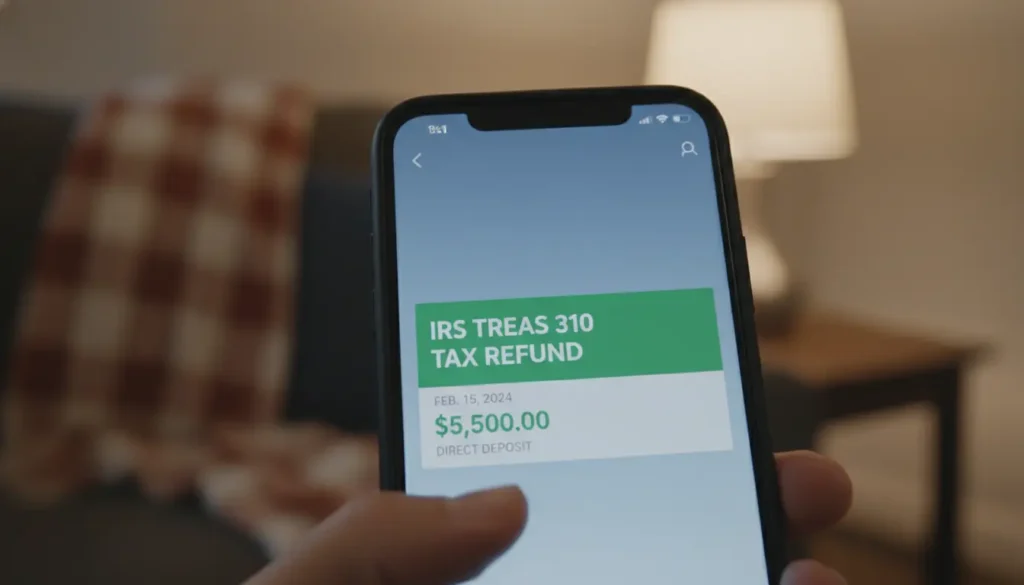

How to know when your deposit arrives

Check your bank account around the announced deposit start date. The IRS will also update its online tools so you can track payment status once the system goes live for the program.

How the IRS Determines Payment Amounts

The $2,000 amount is the baseline for eligible single filers or qualifying heads of household. Payments for married couples filing jointly or households with qualifying children may differ based on the specific legislation and income phaseouts.

Income phaseouts reduce the payment for higher earners. The IRS will apply the calculation using your 2025 tax return or the most recent information available.

What to Do If You Don’t Get the $2,000 Direct Deposit

If you expect a payment but don’t receive it by the end of the payment window, follow these steps to resolve the issue.

- Verify your eligibility by reviewing the IRS guidance for the program.

- Check your bank account and any returned mail for notices from the IRS.

- Use the IRS online tool (when available) to track your payment status.

- If an error occurred with your bank account on file, contact the IRS or follow instructions in the IRS notice to claim the payment or update information.

Common reasons for missing payments

- The IRS has outdated banking details or the payment was returned as undeliverable.

- You were not eligible after IRS verification of income and filing status.

- Processing delays or mailing issues for paper checks and debit cards.

Tax and Reporting Rules

Generally, these payments are treated as a non-taxable government benefit for federal income tax purposes, but you should keep the IRS notice for your records. The IRS will specify whether the payment needs to be reported or affects any credits on your 2026 tax return.

Check state tax rules separately; most states do not tax this type of federal payment.

The IRS typically sends a mailed notice after a direct deposit is made. Hold the notice with your tax records; it shows the payment amount and the tax year the payment applies to.

How to Update Direct Deposit or Bank Info

If you need to update where the IRS sends your payment, do so through the IRS-provided channels. For many programs, you can update banking details on your most recent tax return or via an IRS online portal if available.

Do not share bank or Social Security details in unsolicited emails or calls. Use official IRS websites and phone numbers for changes.

Small Case Study: How a Typical Payment Was Received

Maria, a single parent, filed her 2025 tax return electronically and provided direct deposit information. In mid-January 2026, she saw a deposit posted to her checking account. Two days later, she received an IRS mailed notice confirming the $2,000 payment.

Because Maria kept good records, she matched the notice to her bank deposit and did not need to contact the IRS. This highlights the value of filing returns accurately and keeping bank details current.

Where to Get Official Information and Help

Always consult the IRS website for the latest announcements, payment status tools, and detailed FAQs. Local free tax clinics or a certified tax professional can also help with eligibility questions and follow-up actions.

Useful resources include:

- The official IRS page for the 2025 payments and tracking tools

- IRS phone support for taxpayers with special circumstances

- Local VITA/TCE programs for low-income filers

Final Checklist Before January 2026

- File your 2025 tax return on time if required.

- Verify your direct deposit information on your tax return or with the IRS portal.

- Monitor the IRS payment tracking tool beginning in January 2026.

- Keep IRS payment notices and records for your taxes.

Following these steps will help ensure you receive your IRS $2,000 direct deposit smoothly. If you run into problems, use the official IRS channels and consider professional help for complicated situations.