This guide explains the Federal $2000 deposits scheduled for December 2025. It covers who qualifies, the rules and timelines, how payments are delivered, and practical steps to check and resolve problems.

Who qualifies for Federal $2000 Deposits: eligible beneficiaries

Federal $2000 deposits are targeted payments for specific groups defined by the program. Eligible beneficiaries include people who meet income and status criteria set by the administering agency.

Eligibility rules for beneficiaries

Typical eligibility rules include income thresholds, filing status, and citizenship or residency requirements. Some common conditions are:

- Filing a federal tax return for the most recent tax year or being on a federal benefit list.

- Meeting the adjusted gross income (AGI) limit for single or joint filers.

- Being a U.S. citizen, resident alien, or qualifying nonresident as defined by the program.

Programs often exclude non-filers who did not register or provide banking information before the cut-off date.

ID and documentation required

Beneficiaries may need one or more of the following to confirm eligibility or update payment details:

- Most recent federal tax return or IRS transcript.

- Proof of Social Security Number or Individual Taxpayer Identification Number (ITIN).

- Valid ID for identity verification and proof of residency if requested.

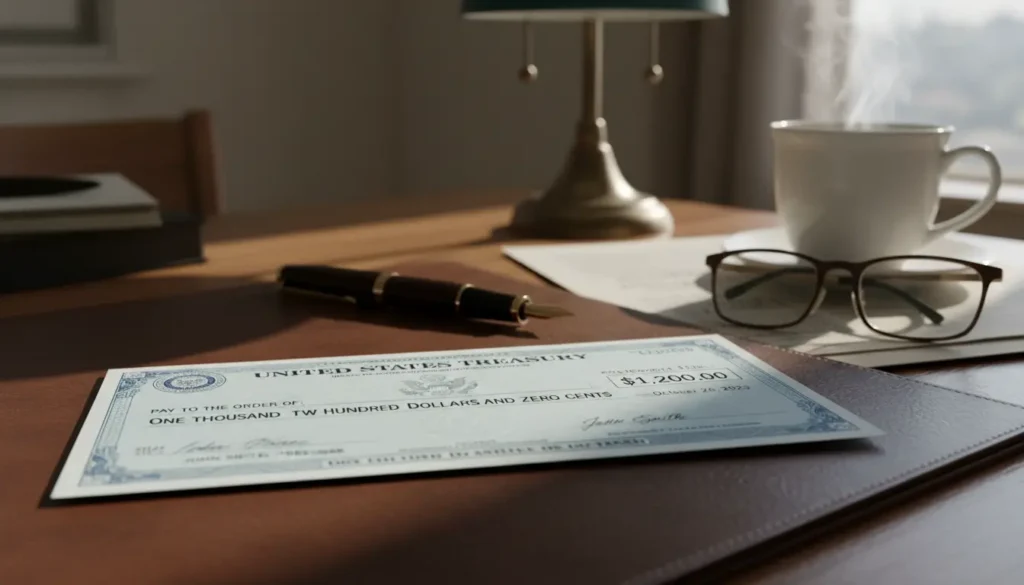

How Federal $2000 Deposits will be sent

Payments are usually sent by direct deposit or mailed paper checks. The method depends on the agency’s records and the payment information on file.

Direct deposit vs. paper check

Direct deposit is the fastest method and is used when a beneficiary’s bank account is on file. Paper checks are mailed if no banking record exists.

- Direct deposit: posts to your bank account and often shows as a description like ‘FEDERAL PAYMENT’.

- Paper check: delivered by mail and must be cashed or deposited within the check’s valid period.

When to expect payments — timelines

The federal agency has scheduled bulk payments to begin in early December 2025 and continue through the month. Timing depends on processing batches and method of delivery.

- Early December: initial batch of direct deposits to active accounts.

- Mid-December: second batch, including some direct deposits and mailed checks.

- Late December: remaining mailed checks and rearranged payments for corrected records.

Rules and timelines for receiving Federal $2000 Deposits

Understanding the specific rules and timelines helps avoid surprises. The agency will publish a final schedule and FAQs on its website.

Important dates in December 2025

- Payment processing starts: first week of December 2025.

- Primary payment window: December 1–20, 2025.

- Final catch-up mailings and adjustments: December 21–31, 2025.

Call centers and online status portals may have reduced hours around holidays, so plan inquiries early.

Exceptions and delays

Delays can result from incorrect banking details, identity verification flags, or address problems. People with legal name changes, recent moves, or unresolved tax issues may see longer waits.

- Incorrect bank routing numbers can cause returns and reissuance as paper checks.

- Identity verification holds require submitting documents and can add several weeks.

Some beneficiaries who did not file a tax return in the last year can still receive payments if they registered with the IRS or the administering agency through a non-filer portal before the deadline.

How to check status and what to do if you don’t receive payment

Use the agency’s online payment tracker or phone line to check status. You will typically need your Social Security number, date of birth, and ZIP code to access status information.

Steps to verify eligibility and bank info

- Visit the official agency payment portal and enter your identity details.

- Confirm whether payment is scheduled as direct deposit or paper check.

- If direct deposit failed, follow instructions to confirm your bank routing and account number or to request a replacement check.

Contact and appeals

If your payment is missing and the portal shows no scheduled payment, contact the agency’s help line. Keep records of calls, reference numbers, and copies of any submitted documents.

- Prepare to submit proof of eligibility or correct tax records.

- File an appeal if the agency denies payment after review; appeal procedures are listed on the agency site.

Case study: Real-world example

Maria is a retired teacher who normally receives federal benefits by direct deposit. Her bank account was on file, so she received the $2000 deposit on December 5, 2025. Her online account showed ‘Payment Posted’ two days before the bank reflected the deposit.

By contrast, Jamal recently changed banks but did not update his information. He did not receive a direct deposit and instead received a paper check by mail on December 22, 2025. He had to visit his bank to deposit the check and update his direct deposit info for future payments.

Final checklist and next steps

- Verify eligibility and make sure your tax records or benefit account are up to date.

- Confirm your bank routing and account numbers in the agency portal before payment dates.

- Monitor the agency’s payment tracker regularly in December 2025.

- If you miss a payment, follow the agency’s instructions to request a replacement or file an appeal.

Staying informed and confirming your contact and banking information are the fastest ways to ensure you receive the Federal $2000 deposit on schedule. Check the administering agency’s official website for the latest updates and specific FAQ guidance.