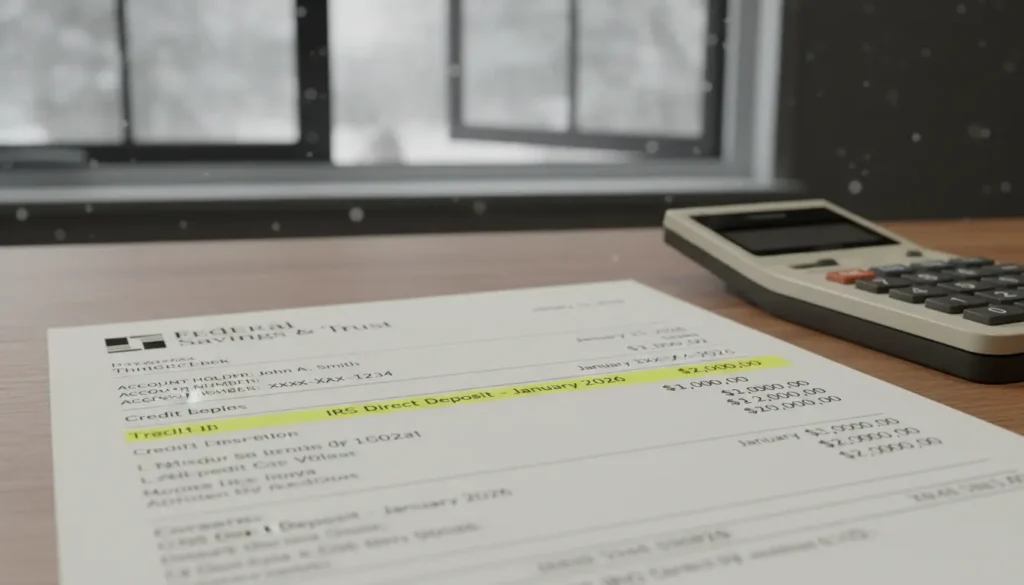

The IRS announced a limited $2,000 direct deposit program opening in January 2026. This article explains the payment windows, eligibility rules, how to check your status, and practical next steps you should take if you expect a deposit.

$2,000 Direct Deposit IRS Alert for January 2026: What to know

The IRS is running a short payment window to send $2,000 direct deposits to qualifying recipients in January 2026. Payments are being issued in batches over several days, not all at once.

Not everyone will get the payment. The IRS is following set rules based on tax filings, income, and previous eligibility checks. Knowing the rules helps you avoid scams and know where to look for your deposit.

Who is likely eligible

Eligibility is based on the IRS criteria announced with the program. Generally, the following groups are prioritized:

- People who filed 2024 or earlier tax returns and claimed qualifying credits.

- Recipients of recent federal benefit payments where the IRS already has direct deposit information on file.

- Tax filers whose adjusted gross income falls within IRS thresholds announced for this program.

If you did not file recent returns or did not provide direct deposit information to the IRS, you may not receive an automatic deposit and might need to take further steps.

Payment windows opened and timing details

The IRS is using multiple payment windows throughout January 2026. Payments are being issued in batches during these windows rather than a single nationwide release.

Typical timing details you should expect:

- Batch releases on set dates in January, announced by the IRS ahead of each release.

- Direct deposits usually post on the morning of the scheduled bank processing day, but banks can vary.

- If your bank rejects a deposit, the IRS will send a notice with instructions on how to claim the funds instead.

How to check if a deposit was sent

To verify whether the IRS attempted a deposit, check these sources first:

- Your bank account activity and recent transactions for a payment description from the IRS.

- The IRS online account portal, which lists recent actions and payments associated with your Social Security number.

- Official IRS notices sent by mail. The IRS often notifies recipients of direct deposits or returned payments by postal mail.

If you expect a deposit but see no activity, wait a few business days after the announced batch date, then contact the IRS if no notice arrives.

Rules clarified: common questions answered

Here are concise answers to frequent questions about the $2,000 direct deposit alert.

- Can the IRS deposit to a different account? No. The IRS will only deposit to the bank account it has on file from your most recent tax return or benefit record.

- Will there be a check if direct deposit fails? The IRS may issue a paper notice or a mailed check in some circumstances, but this depends on returned payments and available contact data.

- Is this taxable? The IRS will state whether the payment is taxable. Most recent similar payments were non-taxable, but confirm with the IRS notice you receive.

- How do I report a missing payment? Follow IRS instructions on the notice you received, or use the official IRS website and secure contact methods.

Watch out for scams

The IRS will not call, text, or email you asking for your bank login or to pay a fee to get the $2,000. Any request for sensitive information is a scam. Always use IRS.gov or your secure IRS account to confirm details.

Next steps: what you should do now

Follow these practical steps to confirm your eligibility and avoid delays.

- Log in to your IRS online account and look for payment activity or messages about the January 2026 deposit.

- Check your most recent tax return for the bank account you provided. If it is outdated, the IRS cannot change it for this batch.

- Monitor your bank account on scheduled batch days and allow 3 business days for processing if you see no deposit immediately.

- If you receive a mailed IRS notice, read it carefully and follow the instructions rather than responding to unsolicited messages claiming to be the IRS.

Paperwork and appeals

If you believe you were eligible but did not get a deposit, collect supporting documents such as your recent tax return, benefit statements, and any IRS notices. Use these if you need to contact the IRS or file a claim.

Appeal or claim processes vary. The IRS typically outlines a step-by-step procedure in its notices and online guidance.

Real-world example

Case study: Maria, a single parent who filed a 2024 tax return with direct deposit information, received an IRS deposit on January 14, 2026. The bank posted the payment and labeled it with an IRS reference number. Maria kept the IRS notice and verified that the payment was non-taxable when she received her confirmation letter a week later.

If your situation is different, use Maria’s checklist: verify your account, watch your mail, and keep records of any IRS communication.

Follow official IRS channels for the most accurate and up-to-date information about the $2,000 direct deposit alert in January 2026. Acting quickly and using secure IRS tools will reduce confusion and help you access any funds you are owed.