Reports of a 2,000 IRS direct deposit in January 2026 have driven many taxpayers to search for clear rules and timelines. This guide explains practical steps to check eligibility, update bank details, track the payment, and protect yourself from scams.

Who might qualify for the 2,000 IRS direct deposit

Eligibility depends on the specific program or credit behind the payment. The IRS commonly issues direct deposits for tax refunds, refundable credits, and authorized stimulus or relief payments.

Before acting, confirm the payment and rules on the official IRS site at IRS.gov. If a notice or announcement covers a January 2026 deposit, the IRS will list who qualifies and what documentation is required.

Common eligibility signals

- Recent IRS announcement or press release naming a one-time payment or credit.

- Eligibility tied to 2024 or 2025 tax year returns (income limits, filing status, dependents).

- Automatic payments for Social Security recipients or other benefit programs noted by federal agencies.

January 2026 rules and documentation

The IRS typically publishes clear rules when it authorizes a payment: who qualifies, income thresholds, and whether the payment is automatic or requires an action.

Keep these documents ready when checking eligibility or updating banking info:

- Most recent tax return (2024 or 2025) and Social Security number.

- Proof of identity if required for online account verification (driver’s license, passport).

- Bank routing and account number if you plan to add or update direct deposit details.

What to expect from the IRS rules

If the 2,000 payment is authorized, rules will typically state whether the payment is:

- Automatic for eligible taxpayers, using recent tax return or SSA records.

- Issued only to taxpayers who file a return or claim a refundable credit.

- Available for bank direct deposit or mailed as a paper check when no bank info exists.

Timeline: When to expect the 2,000 IRS direct deposit

Typical IRS timelines for authorized payments follow stages: announcement, notice mailing, deposit window, and final reconciliation. Expect the process to take several weeks to complete.

A common timeline pattern:

- Week 0: Official announcement and guidance posted on IRS.gov.

- Week 1–2: Notices or letters sent to eligible recipients with instructions.

- Week 2–6: Direct deposits processed and posted to bank accounts in batches.

- Week 6+: IRS issues additional notices for those who did not receive payment or need to claim it.

How the IRS pays and posts deposits

The IRS typically sends deposits on business days, and banks may post them the same day or within 1–2 business days. If you are expecting a payment, check your bank statement and the IRS online tools regularly.

How to secure your 2,000 IRS direct deposit

Follow these steps to increase the chance the IRS will send funds by direct deposit and reduce delays.

- Verify the payment on IRS.gov. Use the exact guidance and links from IRS.gov; do not rely on social media posts or news summaries alone.

- Sign in to your IRS Online Account. Confirm mailing address and payment eligibility notices there.

- Provide or update bank account information through the IRS tool specified in the announcement (for past stimulus payments it was “Get My Payment” or the online account). If no IRS tool is provided, update bank info on your next filed tax return.

- File any required tax return or claim forms promptly. Refundable credits often require an active tax return to receive payment.

- Monitor your bank account for deposit, and keep IRS notices and bank statements in case you need to dispute or inquire later.

Checklist to secure direct deposit

- Confirm identity with IRS online account.

- Have bank routing and account numbers ready (avoid sharing on calls).

- Keep copies of filed returns and IRS notices.

- Watch official IRS timelines and guidance closely.

The IRS has used direct deposit for most refunds since the 1990s. Direct deposit speeds delivery and reduces the chance of lost or stolen paper checks.

Tracking the payment and what to do if it doesn’t arrive

Use IRS online tools first. Many IRS portals show payment status or explain why a payment wasn’t issued. If the portal shows no payment and you believe you are eligible, follow the IRS instructions or contact their support channels listed on IRS.gov.

Do not provide bank details in response to unsolicited calls, emails, or texts. The IRS will not request bank account information via social media or a non-secure message.

When to contact the IRS or your bank

- If the IRS portal confirms a deposit posted but your bank did not receive funds.

- If you received a notice saying a paper check was mailed but you did not receive it.

- If you suspect identity theft or fraudulent activity tied to the payment.

Real-world example

Example: Maria is a part-time teacher who read about the 2,000 deposit and checked IRS.gov. She signed into her IRS Online Account, confirmed a notice showing eligibility, and verified her bank account. Two weeks later, Maria’s bank posted a deposit labeled as a federal payment. She saved the IRS notice and her bank statement in case the IRS requested proof later.

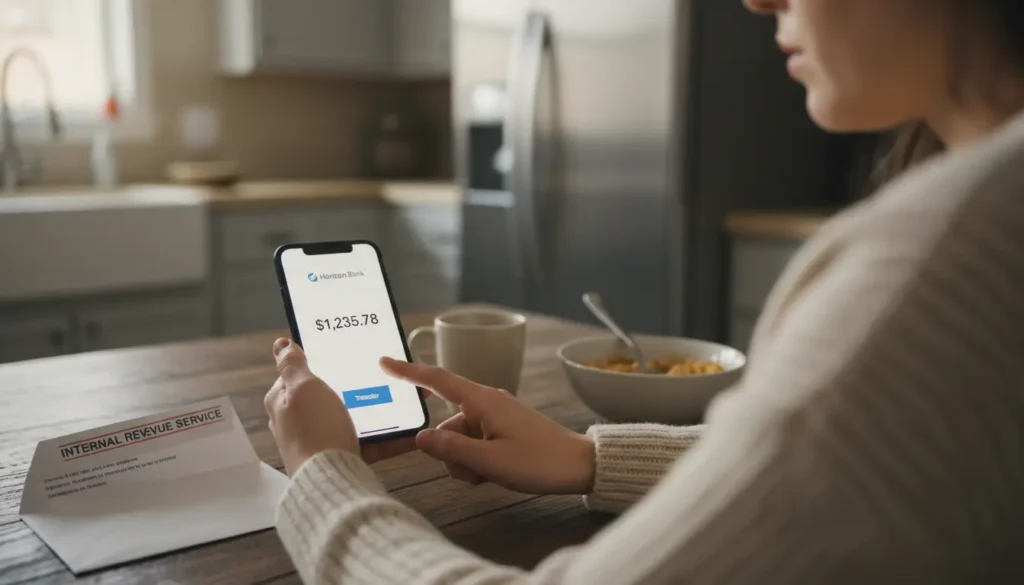

How to avoid scams related to the 2,000 IRS direct deposit

Scammers often use major payment stories to trick people. Follow these safety rules:

- Only use links from IRS.gov or official federal pages.

- Never give your bank login, password, or full Social Security number in response to a call or message you did not initiate.

- Report suspicious calls or messages to the Treasury Inspector General for Tax Administration (TIGTA) and the IRS phishing page.

Following the official IRS guidance, keeping your account information up to date, and watching the IRS timeline will give you the best chance to receive the 2,000 direct deposit quickly and securely in January 2026.