What to expect from the 2000 federal deposits confirmed for December 2025

The federal government has confirmed a one-time deposit of 2000 to eligible recipients in December 2025. This article explains the rules, who qualifies, how payments will be scheduled, and what to do if you need help.

Overview of rules for 2000 federal deposits confirmed for December 2025

These deposits follow a specific set of rules set by the issuing agency. Most rules focus on residency, income, and prior benefit status.

Key rule points include eligibility verification, documentation requirements, and limits on duplicate payments to the same individual.

Primary rules to know

- One-time deposit amount: 2000 per eligible adult or household member when applicable.

- Residency requirement: Must be a resident or a qualified taxpayer in the issuing jurisdiction as of a cutoff date.

- Income limits: Some income bands are excluded; others receive reduced amounts based on means-testing.

- Prior benefits: Recipients of certain government programs may be automatically included.

Eligibility criteria for 2000 federal deposits

Eligibility varies with the program that funds the deposit. Generally, there are three main categories used to determine qualifiers: income, residency status, and program participation.

Who typically qualifies

- Adults with valid government-issued identification and proof of residency.

- Tax filers who meet the income thresholds for the calendar year in question.

- Existing beneficiaries of qualifying federal programs who meet program rules.

Documentation required

- Photo ID (driver’s license, state ID, or passport).

- Proof of residency (utility bill, lease, or government correspondence).

- Recent tax return or proof of income if required by the program.

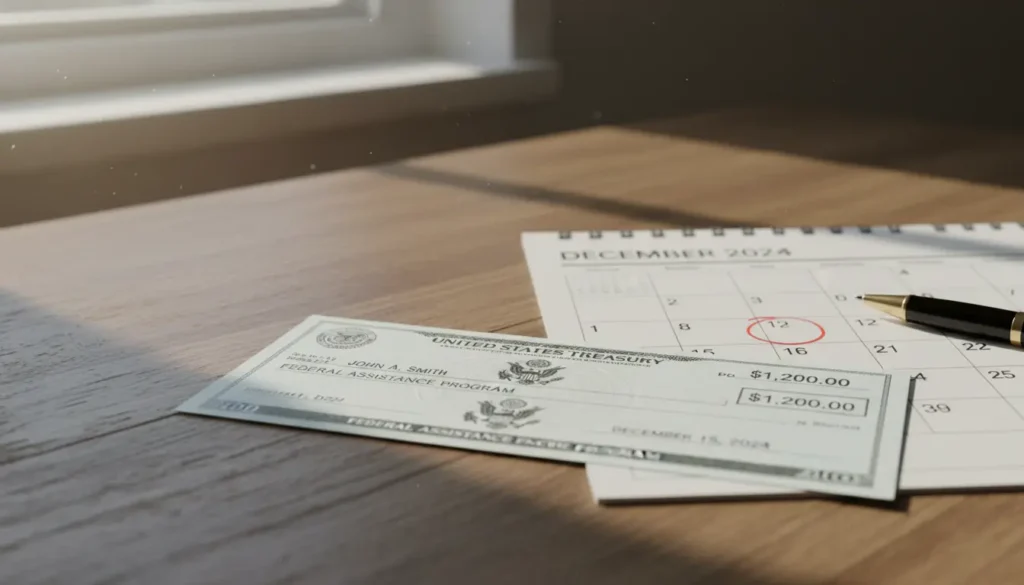

Payment schedule and timeline for December 2025 deposits

The confirmed payment window is December 2025. Agencies will use staged schedules to distribute funds and to avoid system overload.

Typical payment timing

- Automatic direct deposit: Week 1 and Week 2 of December for pre-registered recipients.

- Paper checks mailed: Mid to late December, depending on postal service speed.

- Online claims or late registrations: Payments processed in late December to early January for those who file after cutoff.

How to check payment status and what to do if you do not receive funds

Most agencies provide an online portal and phone line for status checks. You can also monitor your bank account for direct deposit notices or track mailed checks.

Steps to verify status

- Locate the official program website listed in government communications.

- Use the recipient portal to enter your ID and verify scheduled payments.

- Call the agency helpline if the portal does not show your payment or if information is unclear.

If you do not receive payment

- Confirm eligibility and that your banking information is up to date.

- File an inquiry or appeal through the official portal; keep copies of communications.

- If mailed check is lost, request a stop-payment and reissue through the agency.

Some agencies will automatically apply deposits to outstanding debts only when authorized by law. If you receive a notice about offsets, check the official explanation of benefits before taking further action.

Tax and financial implications of the 2000 federal deposits

Whether the deposit is taxable depends on program rules. Some payments are labeled as non-taxable relief, while others could be treated as taxable income.

Check official guidance and consult a tax professional if you expect tax liability changes because of this payment.

Real-world example: How one household received the December 2025 deposit

Case study: A two-adult household who were tax filers and current recipients of a qualifying program were automatically enrolled. Their direct deposit hit their account on December 9, 2025.

They received an email notification from the agency and a follow-up mailed notice explaining tax treatment and how to report issues. This household used the funds for overdue utilities and emergency car repairs.

Tips to prepare before December 2025

- Verify and update banking information with the official portal now to avoid delays.

- Gather ID and proof of residency in case verification is requested.

- Monitor official channels for payment date windows and any supplemental guidance.

Where to get help and official resources

Use only official government websites and phone numbers for inquiries. Beware of scams asking for fees or personal data in exchange for payment access.

Keep records of all communications and confirmations until you receive the funds and any required tax statements.

Final checklist for eligible recipients

- Confirm eligibility and required documentation.

- Update deposit information and monitor the payment portal.

- File a timely inquiry if payment is missing or incorrect.

Following these steps will help you prepare for and manage the 2000 federal deposit confirmed for December 2025. Stay informed through official announcements and maintain records of any correspondence.