If you are expecting a 2,970 direct deposit in 2025, this guide walks you through how to confirm eligibility, monitor key dates, and take practical steps to receive the payment as quickly as possible.

How to check eligibility for 2,970 Direct Deposit 2025

Start with the organization issuing the payment. Payments of this size may come from federal or state programs, an employer, or another agency. Use official channels to verify whether you qualify.

Steps to confirm eligibility

- Find the official announcement: Look for information on the agency or employer website that sponsors the payment.

- Read eligibility rules: Check income limits, filing requirements, residency rules, or enrollment windows that apply to 2025 payments.

- Use online tools: If the issuer provides a portal or payment tracker (for example, government “Get My Payment” style tools), enter your details securely to check status.

- Contact support: Call or email the issuer’s official help line if the online information is unclear or you do not see your name listed.

Keep records of your communications, including confirmation numbers, dates, and the name of any representative you speak with. These help if you need to resolve a timing or eligibility dispute.

Key dates for 2,970 Direct Deposit 2025

Understanding the schedule helps you know when to expect the deposit and how quickly to act if you do not receive it.

Typical timeline items to watch

- Announcement date: The date the payer announces the program and eligibility rules.

- Application or opt-in deadline: If you must apply or confirm details, note the final day to act.

- Payment issuance window: Many agencies issue batches of direct deposits over a range of days or weeks.

- Deposit posting: Once the payer sends the transfer, your bank typically shows the funds in 1–3 business days.

Example timeline: If the agency issues deposits starting June 1 in batches and your payment is scheduled in the second batch, you may see the deposit between June 8 and June 14, depending on processing and weekends.

How to get your 2,970 payment fast

Follow these practical steps to speed up receipt of a direct deposit and reduce delays.

1. Confirm and update direct deposit information

Make sure the payer has your correct bank routing and account numbers. If you change banks, update this information immediately through the payer’s secure portal or by contacting their support.

2. Enroll in electronic delivery

If a program offers both check and direct deposit, opt for direct deposit. Electronic transfers are faster and less likely to be lost than paper checks.

3. Check eligibility early and apply on time

Missing an application or documentation deadline is a common cause of delay. Submit any required forms promptly and double-check that they were received.

4. Verify identity quickly

Some payments require identity verification. Complete identity checks promptly to avoid hold-ups. Use the issuer’s recommended verification method.

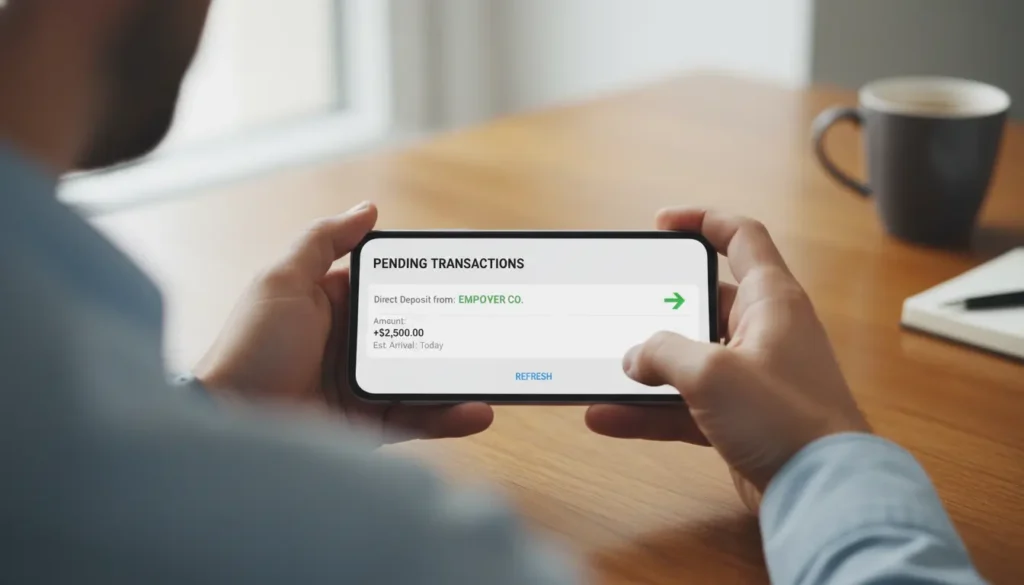

5. Monitor your bank and payer portals

Check both your bank account and the payer’s online status tool. Sometimes the payer shows “sent” before the bank posts the deposit, and tracking both helps you know where the delay is occurring.

What to do if your 2,970 direct deposit is late

Use a step-by-step approach to find and fix the issue.

- Confirm the payer’s issuance date and batch schedule.

- Check your bank for pending deposits or holds placed by the bank.

- Contact the payer with your eligibility ID or application number handy.

- Ask your bank if the deposit is pending or rejected due to account details.

If the payer confirms the deposit was sent but your bank shows nothing, request a trace or proof of payment from the issuer. This helps banks locate incoming transfers faster.

Security and scam warnings

Scammers often target people expecting government or benefit payments. Protect yourself with these rules.

- Only use official websites and phone numbers to check status or provide account information.

- Never give your bank password or full Social Security number by email or over the phone.

- Ignore unsolicited messages promising faster payments for a fee.

Direct deposits are usually posted by banks within 1–3 business days after the payer sends them. International transfers or missing account details can add extra time to posting.

Short case study: How one person sped up a delayed payment

Case: Maria expected a 2,970 direct deposit from a state benefit program. Her payment did not appear on the expected date.

- What she did: Maria verified her eligibility online, confirmed the payer had her current bank routing number, and called the program support line to request a payment trace.

- Outcome: The payer reissued the deposit after finding a data entry error. The second direct deposit posted within two business days to Maria’s account.

Lesson: Early verification of account details and prompt contact with the issuer can resolve many delays without long waits.

Final checklist to get your 2,970 Direct Deposit 2025 fast

- Confirm you meet eligibility rules and apply on time.

- Provide correct direct deposit details and enroll in electronic delivery.

- Complete any identity verification quickly.

- Monitor payer and bank portals and save all confirmation numbers.

- Contact the payer immediately if the deposit is late and request a trace.

Following these steps helps most people receive expected direct deposits faster and with fewer problems. If you still have concerns, reach out to the issuing agency or your bank for specific guidance tailored to your situation.