Many taxpayers are searching for clear guidance on the 2000 IRS direct deposit expected in January 2025. This article explains who may qualify, the official rules, the likely timeline, and precise steps you can take to secure your payment.

What the 2000 IRS Direct Deposit Means

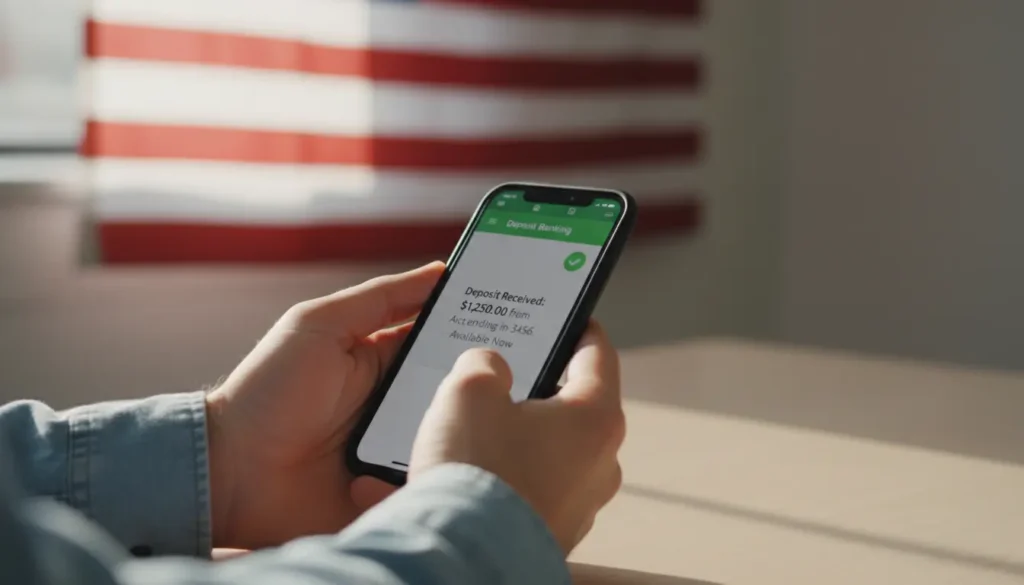

The 2000 IRS direct deposit refers to a one-time payment of 2000 sent by the IRS to eligible individuals. The payment is delivered by electronic deposit to the bank account the IRS has on file, when possible.

This guide focuses on practical steps and timelines so you can check eligibility and reduce delays in receiving funds.

Who Qualifies for the 2000 IRS Direct Deposit

Eligibility depends on rules published by the IRS and the specific program that funds the payment. Common eligibility criteria include adjusted gross income limits, filing status, and dependent rules.

- Filed a recent federal income tax return or used the IRS non-filers tool.

- Meet income thresholds or other program-specific requirements.

- Have valid Social Security numbers and U.S. residency status for tax purposes.

How the IRS Verifies Eligibility

The IRS cross-checks tax-filing records, Social Security Administration data, and program rules. If the IRS needs extra information, it may contact you by mail — not by phone or email — to request documentation.

January 2025 Rules and Important Notes

For January 2025 payments, watch for official IRS announcements and guidance. Key points usually include:

- Payments are automatic for qualifying taxpayers who filed returns for the relevant year.

- Direct deposit is the fastest delivery method the IRS uses when bank information is on file.

- If your bank account information is missing or outdated, the IRS may mail a paper check or a prepaid debit card instead.

Always rely on IRS.gov for official confirmation. Avoid third-party sites claiming to register you for payments for a fee.

Timeline: When to Expect Your 2000 IRS Direct Deposit

Exact dates vary by program, processing speed, and individual circumstances. A typical timeline looks like this:

- Announcement and guidelines published: early January 2025.

- IRS begins electronic deposits: within 1–3 weeks after announcement for prioritized groups.

- Most direct deposits complete: within 2–6 weeks for eligible recipients.

- Paper checks and prepaid cards mailed: later in the process, often several weeks after deposits.

Direct deposits often arrive before paper payments because electronic transfers bypass printing and mailing steps.

How to Secure Your 2000 IRS Direct Deposit

Follow these steps to maximize the chance your payment arrives by direct deposit and on time.

- Confirm you filed a return for the relevant tax year or used the IRS non-filer or equivalent registration tool.

- Make sure the IRS has your correct bank routing and account numbers from your most recent tax return.

- Use the IRS Get My Payment or the IRS online account portal to check payment status when available.

- Fix errors early: if your bank information is wrong, update it only through IRS-secure channels or by filing an amended return as instructed.

- Watch for IRS mail: if the IRS needs documents, respond quickly to avoid delays.

Practical Steps to Update Bank Info

Do not give bank details to callers or email requests claiming to be the IRS. Instead use:

- The IRS online account (IRS.gov) to view or update information when offered by the IRS.

- Your most recent tax return — it is the primary record the IRS uses for direct deposit routing.

- A new tax return filing if you never filed and are now required to register for a payment.

The IRS sends most direct deposit payments at no cost and prioritizes electronic delivery because it is faster and more secure than paper checks.

Common Delivery Issues and How to Fix Them

Some taxpayers do not receive deposits due to incorrect bank numbers, closed accounts, or mismatched names. Common fixes include:

- Verify account and routing numbers on a recent bank statement.

- Check that the name on your tax return matches the name on the bank account.

- Contact your bank if a deposit posts and then reverses; the bank can explain return reasons.

What to Do If You Don’t Get the Payment

Wait the full processing window first, then check the IRS Get My Payment tool or your IRS online account. If the status shows an error or you still do not receive funds after the timeline, contact the IRS directly or consult a tax professional.

Small Real-World Case Study

Example: Maria, a single parent in Ohio, expected the 2000 payment in January 2025. She filed 2024 taxes early and verified her bank routing number on January 5. By January 23 she saw a deposit notification from her bank. When a portion returned due to a routing digit error, she fixed it with her bank and the IRS reissued the deposit two weeks later. The total time from announcement to final receipt was six weeks.

Takeaway: early verification and using official IRS tools reduced Maria’s wait time and resolved the issue quickly.

Final Checklist to Protect Your Payment

- File required tax returns promptly and accurately.

- Confirm bank account details on file with the IRS.

- Use IRS.gov tools to check status; beware of scams.

- Respond fast to any official IRS mail requests for documentation.

Following these steps will help you understand the rules, track the timeline, and secure your 2000 IRS direct deposit in January 2025. For official confirmation and tools, go to IRS.gov and use secure IRS channels only.