This article explains eligibility rules, the payment schedule, and steps to ensure you receive the 2,000 federal direct deposit in January 2026. Read practical instructions to confirm your status, update banking details, and understand exceptions.

Who is eligible for the 2,000 Federal Direct Deposit

Eligibility for the 2,000 federal direct deposit depends on criteria set by the issuing federal program. Most commonly, the program targets adults who meet income, tax filing, or benefit requirements set by the government.

Basic eligibility rules for the 2,000 Federal Direct Deposit

Typical eligibility checks include recent tax returns, benefit enrollment, or Social Security records. You will usually need to have filed a tax return for the previous year or be enrolled in qualifying federal benefit programs.

- Filed a 2024 or 2025 federal tax return, or

- Currently receiving qualifying federal benefits (example: Social Security, SSI, or other designated programs), or

- Meet income thresholds or dependent conditions if specified in program guidance.

Confirm eligibility through the official federal website or the agency that announced the deposit. Avoid relying on third-party posts or social media claims.

How the 2,000 Federal Direct Deposit payment schedule works in January 2026

Payments are often issued in a phased schedule to manage processing. The schedule is typically based on filing status, benefit cycles, or last two digits of a Social Security number.

Typical payment timeline for January 2026

While exact dates will be published by the issuing agency, expect the following general pattern. Agencies commonly release a calendar with specific deposit dates tied to groups.

- Early January: Priority group releases (automatic direct deposit recipients, active benefit recipients).

- Mid-January: Tax-filers with direct deposit on file receive payments.

- Late January: Manual or mailed payments for those without direct deposit information.

Check your bank account on the morning of your scheduled date. Banks can post deposits at different times depending on processing windows.

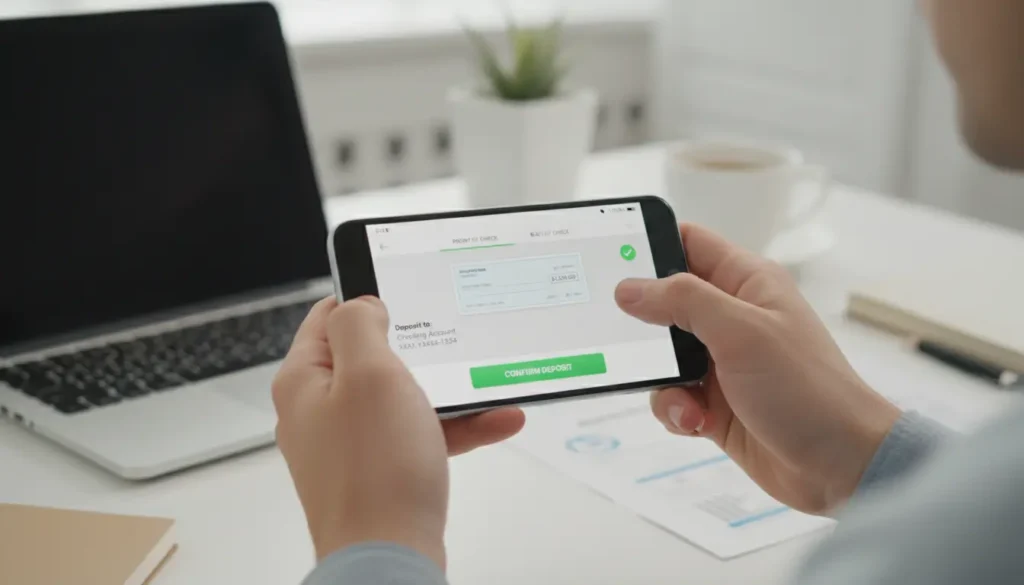

How to apply or update information for the 2,000 Federal Direct Deposit

To receive the payment by direct deposit, verify or add your bank account with the agency handling the payment. Many agencies allow online updates using secure portals.

Steps to set up or update direct deposit

- Locate the official agency web portal (do not use unfamiliar links).

- Sign in with your secure account or create one if required.

- Enter routing number and account number exactly as shown on your checks or bank statements.

- Confirm account type (checking or savings) and save changes.

- Print or save confirmation for your records.

If you prefer, contact the agency by phone for confirmation. Allow several business days for updates to take effect before the scheduled payment date.

What to expect: amounts, taxes, and exceptions for the 2,000 Federal Direct Deposit

The payment amount should be 2,000 before any applicable offsets. Federal payments are usually not taxable at issuance, but they may affect benefits or be subject to offsets for debts like child support or federal loans.

- Amount: Typically a single payment of 2,000 unless the program specifies phased or partial payments.

- Taxes: Check official agency guidance about taxability; often non-taxable but reportable in some circumstances.

- Offsets: Debts owed to federal or state agencies may reduce the payment amount.

If you see a smaller deposit, contact the issuing agency immediately to request an explanation and a transaction breakdown.

Many direct deposits are processed by noon local time on the listed date. If you rely on mailed checks, expect delays beyond the direct deposit schedule.

Common issues and troubleshooting for the 2,000 Federal Direct Deposit

Common problems include incorrect routing numbers, mismatched names on account, and stale contact information. Resolve issues quickly by confirming details and contacting your bank or the issuing agency.

How to fix a missing or incorrect deposit

- Confirm the payment date in agency notices or your online account.

- Check your bank statement for incoming deposits and pending transactions.

- Contact the agency if the deposit is missing after the scheduled date; have proof of identity and account details ready.

Document all communications, including dates, names, and reference numbers. This speeds dispute resolution if funds are delayed or misapplied.

Real-world example: A simple case study

Maria filed taxes in 2025 and had direct deposit on file with the federal agency handling the payment. She confirmed her routing and account number two weeks before the scheduled dates.

On the announced mid-January date, her bank posted the 2,000 deposit by 9:45 AM local time. She received an online confirmation from the agency and used the funds to cover rent and a car repair.

This example shows that early verification and using the official agency portal reduce the risk of delays or errors.

Quick checklist to get ready for the 2,000 Federal Direct Deposit

- Confirm eligibility on the official agency website.

- Update or verify direct deposit routing and account number.

- Save confirmation receipts after changes.

- Monitor your bank account on the announced payment date.

- Contact the issuing agency immediately if the deposit is missing or reduced.

Follow these steps to increase the chances of receiving the full deposit on time. For final details and official dates, always check the federal agency that announced the program.